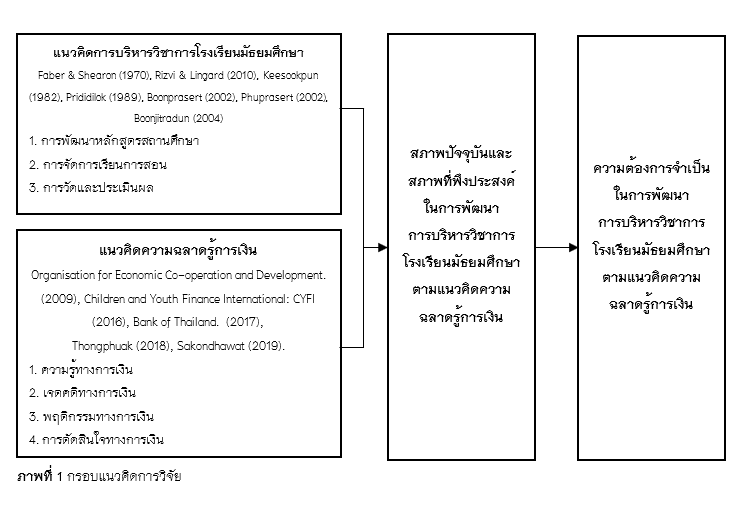

Needs in Academic Management Development of Secondary Schools Based on the Concept of Financial Literacy

Main Article Content

Abstract

The purposes of this research were to: 1) study the actual and desired states of academic management development of secondary schools based on the concept of financial literacy; and 2) study the priority needs in academic management development of secondary schools based on the concept of financial literacy. The population was 2,361 schools under the Office of the Basic Education Commission. The samples were 331 schools, selected by stratified random sampling and simple random sampling. The informants were principals and teachers who performed the head of academic affairs, totaling 662 people. The research instrument was a 5-level rating scale questionnaire with 0.984 actual state reliability and 0.944 desirable state reliability. The data were analyzed by mean, standard deviation, and Modified Priority Needs Index (PNImodified).

The results revealed; 1) The actual states were at a moderate level overall, with terms of schools’ curriculum development having the highest average, followed by teaching and learning management, and measurement and evaluation having the lowest average. As for the desirable state, overall, it was at a high level. The desirable states of teaching and learning management had the highest average, followed by the schools’ curriculum development and measurement and evaluation, which had the lowest average. 2) The overall needs in academic management development of secondary schools based on the concept of financial literacy had PNImodified = 0.168, arranged as follows: No. 1 was teaching and learning management, No.2 was measurement and evaluation, and No.3 was schools’ curriculum development.

Downloads

Article Details

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

References

Atkinson, A. (2006). Levels of financial capability in the UK: Results of a baseline survey. London: Financial Services Authority.

Australian Securities & Investments Commission. (2011). National financial literacy strategy. Melbourne: Australian Securities and Investments Commission.

Bank of Thailand. (2013). Report on the results of the Thai financial skills survey 2013. Bangkok: Bank of Thailand. [In Thai]

Bank of Thailand. (2017). Report on the results of the Thai financial skills survey 2016. Bangkok: Bank of Thailand. [In Thai]

Bank of Thailand. (2021). Report on the results of the Thai financial skills survey 2020. Bangkok: Bank of Thailand. [In Thai]

Boonjitradun, N. (2008). Principles and theories in educational administration. Bangkok: Theimfa. [In Thai]

Boonprasert, U. (2002). School-based management. Bangkok: Chulalongkorn University. [In Thai]

Bureau of Academic Affairs and Educational Standards. (2022). The competency-based learning activity package to promote the financial literacy of lower secondary school students. Bangkok: Kaew Chaochom Media and Publishing Center. [In Thai]

Chaemchoy, S. (2018). School management in digital era. Bangkok: Chulalongkorn University. [In Thai]

Children and Youth Finance International (CYFI). (2016). Financial inclusion for children and youth. Amsterdam: CYFI and GIZ.

Faber, C. F. & Shearon, G. F. (1970). Elementary school administration. New York: Holt Rhinehart and Winston.

Financial Service Authority. (2005). Measuring financial capability: An exploratory study. London: The Financial Service Authority.

Hilgert, M. A. & Hogarth, J. M. (2003). Household financial management: The connection between knowledge and behavior. Federal Reserve Bulletin, 2003(issue Jul), 309-322.

Human Resources Development Working Group. (2014). APEC Guidebook on financial and economic literacy in basic education. China: National Institute of Education Sciences of China.

Inlakorn, S. (2020). An analysis of financial literacy of the students at Kasetsart University Sri Racha Campus. Interdisciplinary Sripatum Chonburi Journal, 6(2), 78-90. [In Thai]

Keesookpun, E. (1982). Principles of general educational administration. Bangkok: Chulalongkorn University. [In Thai]

Kenan Foundation Asia. (2015). Thai people move forward and pay attention to finances project. Bangkok: Kenan Foundation Asia. [In Thai]

Kraisongkram, P. (2021). Guidelines for promoting financial literacy of senior high school students: A multilevel structural equation model. (The Master of Education Thesis, Education Statistics and Information, Chulalongkorn University). [In Thai]

Krejcie, R. V. & Morgan, D. W. (1970). Determining sample size for research activities. Educational and Psychological Measurement, 30(3), 607–610.

Luhrmann, M. (2015). The impact of financial education on adolescents’ intertemporal choices. American Economic Journal: Economic Policy, 10(3), 309-320.

Lyons, C. A. (2015). Translating financial education into behavior change for low-income populations. Association For Financial Counseling and Planning Education, 17(2), 27-45.

Ministry of Education. (2002). National Education Act, B.E. 2542. Bangkok: Prikwan Graphic.

National Statistical Office Thailand. (2021). Summary of important results survey of household economic and social conditions 2021. Bangkok: National Statistical Office, Ministry of Digital Economy and Society. [In Thai]

Neill, A., Berg, M., & Stevens, L. (2014). Financial literacy of secondary students, and its place within secondary schools. New Zealand: New Zealand Council for Educational Research.

Office of the National Economic and Social Development Council. (2021). Documents for brainstorming on the National Economic and Social Development Plan No. 13 (2023-2027). Bangkok: Office of the National Economic and Social Development Council. [In Thai]

Organisation for Economic Co-operation and Development (OECD). (2005). Improving financial literacy: Analysis of issues and policies. Paris: OECD Publishing.

Organisation for Economic Co-operation and Development (OECD). (2009). Financial literacy and consumer protection: Overlooked aspects of the crisis. Paris: OECD Publishing.

Organisation for Economic Co-operation and Development (OECD). (2017). PISA 2015 Results (Volume IV): Students’ financial literacy. Paris: OECD Publishing.

Organisation for Economic Co-operation and Development (OECD). (2020). OECD/INFE 2020 International survey of adult financial literacy. Paris: OECD Publishing.

Organisation for Economic Co-operation and Development (OECD). (2022). OECD/INFE Toolkit for measuring financial literacy and financial inclusion 2022. Retrieved from https://www.oecd.org/financial/education/2022-INFE-Toolkit-Measuring-Finlit-Financial-Inclusion.pdf

Phuprasert, K. (2002). Academic administration in school. Bangkok: Methitips. [In Thai]

Prididilok, K. (1989). The basic of administration and educational supervision. Bangkok: Chulalongkorn University. [In Thai]

Pruksakorn, W. (2015). The academic affairs administration innovations. (The Doctor of Philosophy Thesis, Educational Administration, Silpakorn University). [In Thai]

Ra-Ngubtook, W. (2020). Thai learners’ key competencies in a VUCA world. Journal of Teacher Professional Development, 1(1), 8-18. [In Thai]

Rizvi, F. & Lingard, B. (2010). Globalizing education policy. London: Routledge.

Royal Society of Thailand. (2019). Why create literacy: study from phenomena and predict the future. Bangkok: Academy of Moral and Political Sciences, Royal Society of Thailand.

Sakondhawat, K. (2019). Development of economic learning activity package sing scenario-based learning to promote financial literacy of lower secondary school students. (The Master of Education Thesis, Curriculum and Instruction, Chulalongkorn University). [In Thai]

Sawatzki, C. & Sullivan, P. (2017). Teachers’ perceptions of financial literacy and the implications for processional learning. Australian Journal of Teacher Education, 42(5), 51-65.

Sevcík, K. (2015). PISA 2012 results: Students and money: Financial literacy skills for the 21st century (Volume VI). Pedagogicka Orientace, 25(4), 23-29.

Sibley, J. (2010). Financial capability, financial competence and wellbeing in rural Fijian households. Fiji Island: United Nations Development Programme Pacific Centre.

Swiecka, B. (2020). Financial literacy: The case of Poland. Sustainability, 12(2), 129-135.

Thananiwat, C. (2020). The development of financial literacy scale for lower secondary school students. (The Master of Education Thesis, Educational Measurement and Evaluation, Chulalongkorn University). [In Thai]

Thomson, S. & Bortoli, L. D. (2017). PISA 2015: Financial literacy in Australia. Retrieved from https://www.oecd.org/pisa/PISA-2105-Financial-Literacy-Australia.pdf

Thongphuak, P. (2018). Effects of economics instruction by using simulation games on financial literacy of upper secondary school students. (The Master of Education Thesis, Curriculum and Instruction, Chulalongkorn University). [In Thai]

Tschache, C. A. (2009). Importance of financial literacy and financial literacy content in curriculum. California: Commercial Bank of California.