Traditional Lease and Ideal Lease: The Subtle Meanings of Lease Length

Main Article Content

Abstract

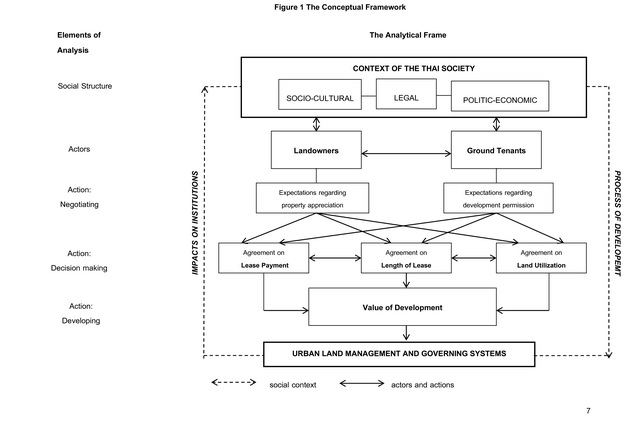

Despite the same few components of ground leases, an important variable that differentiates traditional lease from ideal lease is the length of leasehold term. Ground leases in Thailand can be granted in compliance with two laws: the Civil and Commercial Code, and the Hire Act of Immovable Property for Commerce and Industry B.E. 2542 (1999). While the former is the traditional lease releasing the maximum term of the leasehold at 30 years, the latter is the recent law extending the period of lease to 50 years. Nonetheless, there have been many attempts to extend the ideal lengths of lease to 90 – 99 years. Each length of lease, either the traditional or the ideal one, could be considered as a magic number. The backgrounds of such numbers illustrate not only the movement of the market altered by socio-economic circumstances, but also the tension between the traditional lease and the ideal lease which is based on longer time periods. However, it is interesting in that a leasehold agreement is still generally based on the 30-year leasehold tenure. Thus, the attention to leases in this paper is paid to the determination and application of length term, as well as the subtle meaning of each length of lease.

Downloads

Article Details

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

All material is licensed under the terms of the Creative Commons Attribution 4.0 International (CC-BY-NC-ND 4.0) License, unless otherwise stated. As such, authors are free to share, copy, and redistribute the material in any medium or format. The authors must give appropriate credit, provide a link to the license, and indicate if changes were made. The authors may do so in any reasonable manner, but not in any way that suggests the licensor endorses you or your use. The authors may not use the material for commercial purposes. If the authors remix, transform, or build upon the material, they may not distribute the modified material, unless permission is obtained from JARS. Final, accepted versions of the paper may be posted on third party repositories, provided appropriate acknowledgement to the original source is clearly noted.

References

Archer, R. W. (1971). The leasehold system of urban development: Decision-making, land tenure and the property market in urban development and land use. London: London University College (School of Environmental Studies).

Archer, R. W. (1974). The leasehold system of urban development: Land tenure, decision-making and the land market in urban development and land use. Regional Studies, 8(3-4), 225-238.

Askew, M. (2002). Bangkok: Place, practice and representation. London: Routledge.

Cheng, F. J., & Fu, Y. et al. (2003). Value of redevelopment option in land: Evidence from leasehold value decay. The AREUEA Annual Meeting, January 3-5, Sandiago, n.a.

Durand-Lasserve, A. (1980). Speculation on urban land, land development and housing development in Bangkok: Historical process and social function 1950-1980. Paper presented to the Thai-European Seminar on Social Change in Contemporary Thailand, 28-30 May, Bangkok.

Hansasooksin, S. T. (2012). Urban geography: An institutional approach to people and urban space. In Horayangkura, V. & Jamieson, W. (Eds.). The design and development of sustainable cities (pp. 93-115). Bangkok: GBP Center Co., Ltd. 93-115.

Keyes, C. F. (1987). Thailand: Buddhist kingdom as modern nation-state. Boulder: Westview Press.

Khumpaisal, S. (2012). A classification of risks in real estate development business. Journal of Architectural Research and Studies, 8(2), 1-18.

Mera, K. & Renaud, B. (2000). How real estate contributed to the Thailand financial crisis. In B. Renaud. Asia’s financial crisis and the role of real estate. New York: M.E. Sharpe.

Onchan, T. (1990). A land policy study. Bangkok: TDRI.

Tantikul, V. (1973). Land tenure in Thailand. The Indonesian core seminar on law and modernization, School of Law (Boalt-Hall), University of California Berkeley.

Thannews. (2011). Thailand need for a 90-year lease. Thansettakij. Retrieve January 2012, from http://www.thannews.th.com/index.php?option=com_content&view=article&id=97765:--90-&catid=129:2009-02-08-11-47-38&Itemid=479

Uwanno, B. (2006). Dynamics of Thai politics. The United States - Thailand Relationship and Southeast Asia, Arlington Virginia.

Wanichwatana, S. (2006). The cyclic process of the Thai real estate: Why and How?. Journal of the Government Housing Bank, 12(47), 44-50.

Bangkokbiznews. (2009). Ninety-year leasehold in Thailand from foreigners’ viewpoints. Retrieve March 2012 from http://www.thaihomeonline.com/article/property/2735/

Yuthamanop, P. & Katharangsiporn, K. (2008). Foreign property ownership: Government considers longer leasehold terms. Bangkok Post, (May 5, 2009). Retrieved from http://www.bangkokpost.com/Business/15May2008_biz28.php.

Adams, D. & Disberry, A. et al. (2002). The impact of land management and development strategies on Urban redevelopment prospects. In S. Guy & J. Henneberry (Eds.). Development and developers: Perspectives on property. Oxford: Blackwell Publishing.

Arghiros, D. (2001). Democracy, development and decentralization in provincial Thailand. Surrey: Curzon Press.

Ball, M. (1998). Institutions in British property research: A review. Urban Studies, 35(9), 1501-1517.

Ball, M. (2002). The organization of property development professions and practices. In S. Guy & J. Henneberry (Eds.). Development and developers: Perspectives on property. Oxford: Blackwell Publishing.

Ball, M. (2006). Markets and institutions in real estate and construction. Oxford: Blackwell Publishing.

Bernard, C. H. & Butcher, W. R. (1989). Landowner characteristics: A basis for locational decisions in the urban fringe. American Agricultural Economics Association, 71(3), 679-684.

Baum, A. & Nunnington, N. et al. (2007). The income approach to property valuation. London: Estates Gazette Books.

Baum, A. & Crosby, N. (2008). Property investment appraisal. Oxford: Blackwell Publishing.

Cannadine, D. (1980). Urban development in England and America in the nineteenth century: Some comparisons and contrasts. The Economic History Review, 33(3), 309-325.

Chatchotidham, N. & Chummi, V. (2006). The 3 decades of Thailand’s economy. Journal of the Government Housing Bank, 12(47), 53-61.

Crosby, N. & Gibson, V. et al. (2003). UK commercial property lease structures: Landlord and tenant mismatch. Urban Studies, 40(8), 1487-1516.

Dale-Johnson, D. (2001). Long-term ground leases, the redevelopment option and contract incentives. Real Estate Economics, 29(3), 451-484.

D’Arcy, E. & Keogh, G. (1988). Territorial competition and property market process: An exploratory analysis. Urban Studies, 35(8), 1215-1230.

D’Arcy, E. & Keogh, G. (1999). The property market and urban competitiveness. Urban Studies, 36(5-6), 917-928.

D’Arcy, E. & Keogh, G. (2002). The market context of property development activity. In S. Guy & J. Henneberry (Eds.). Development and developers: Perspectives on property. Oxford: Blackwell Publishing.

Dehesh, A. & Pugh, C. (2000). Property cycles in a global economy. Urban Studies, 37(13), 2581-2602.

Evans, A. W. (2004). Economics, real estate and the supply of land. Oxford: Blackwell Publishing.

Goodchild, R. & Munton, R. (1985). Development and the landowner: An analysis of the British experience ch.1, 5, 9. London: George Allen & Unwin.

Gore, T. & Nicholson, D. (1991). Models of the land-development process: A critical review. Environment and Planning A, 23(5), 705-730.

Guy, S. & Henneberry, H. (2000). Understanding urban development processes: Integrating the economic and the social in property research. Urban Studies, 37(13), 2399-2416.

Guy, S. (2002). Developing interests: Environmental innovation and the social organization of the property business. In S. Guy & J. Henneberry (Eds.). Development and developers: Perspectives on property. Oxford: Blackwell Publishing.

Havard, T. (2002). Contemporary property development. London: RIBA Enterprises.

Healey, P. (1991). Models of the development process: A review. Journal of Property Research, 8(3), 219-238.

Healey, P. (1992). An institutional model of the development process. Journal of Property Research, 9(1), 33-44.

Henneberry, J. & Rowley, S. (2002). Developer’s decisions and property market behavior. In S. Guy & J. Henneberry (Eds.). Development and Developers: Perspectives on Property. Oxford: Blackwell Publishing.

Hodgson, G. M. (1998). The approach of institutional economics. Journal of Economic Literature, 36(1), 166-192.

Horata, P. (2008). Analysis: New valuation of land price 2008. Real Estate Information Center Journal, 3(7), 19-24.

Hurd, R. M. (1970). Principles of city land values. New York: Arno Press and The New York Times.

Institute, the Maekhong Environment and Resource. (2005). Study for the action plan for development of the Suvarnabhumi aerotropolis: Executive summary. Bangkok: Office of the National Economic and Social Development Board.

Institute of Social and Economic Policy. (1999). Laws of economic recovery and the future of the nation. Bangkok: Ruam Duay Chuay Gan.

Issac, D. (2002). Property valuation principles. Hampshire: Palgrave.

Keogh, G. & D’Arcy, E. (1999). Property market efficiency: An institutional economics perspective. Urban Studies, 36(13), 2401-2414.

Kom Chad Luek. (2008). The leasehold tenure by the royal decree: The case of lease negotiation between SRT and CPN. Kom Chad Luek. Bangkok. Retrieved April 12, 2010, from http://sanook.com/politic/politic120740.php

Leishman, C. (2003). Real estate market research and analysis. Hampshire: Palgrave.

Lowndes, V. (2002). Institutionalism. In D. Marsh & G. Stoker. Theory and methods in political science. Hampshire: Palgrave Macmillan.

Magalhaes, C. D. (2002). Global players and the re-shaping of local property markets: Global pressures and local reactions. In S. Guy & J. Henneberry (Eds.). Development and Developers: Perspectives on Property. Oxford: Blackwell Publishing.

McAnulla, S. (2002). Structure and agency. In D. Marsh & G. Stoker (Eds.). Theory and methods in political science. Hampshire: Palgrave Macmillan.

McDonald, I. J. (1969). The leasehold system: Towards a balanced land tenure for urban development. Urban Studies, 6(2), 179-195.

Mera, K. & B. Renaud (2000). Real estate cycles and banking crises in Asia: What have we learned?. In B. Renaud. Asia’s financial crisis and the role of real estate. New York: M.E. Sharpe, 225-276.

Monthaphan, P. (2007). The analysis of returns on leasehold residential investment. Journal of the Government Housing Bank, 13(48), 42-45.

O’Sullivan, A. (2003). Urban economics. New York: McGraw-Hill.

Panyarachun, A. (1996). His Majesty’s role in the making of Thai history. The 14th Conference of the International Association of Historian of Asia, Chulalongkorn University.

Rashiwala, K. (2008). Reality check for 99-year lease extensions: Recent decisions show extensions are no longer a certainty. Bangkok Post. Bangkok. Retrieved April 9, 2009, from http://www.bangkokpost.com/190708_Business/19Jul2008_biz007.php

Rudiger, K. (1989). Bangkok and modernity. Bangkok: Chulalongkorn University Social Research Institute.

Sayce, S. & Smith, J. et al. (2006). Real estate appraisal form value to worth. Oxford: Blackwell Publishing.

Securities and Exchange Commission of Thailand. (2007). Property funds: A new strategy for real estate investment. Journal of Government Housing Bank, 13(48), 50-55.

Team Consulting Engineering and Management. (2003). Suvanabhumi Aerotropolis Development Plan (Final report). Bangkok: Office of the Suvarnabhumi Airport Development Committee, Office of National Economic and Social Development Board.

Torsuwan, P. (2006). CU and the Act of capitalization. Bangkok Biz News. Bangkok. Retrieved December 13, 2011, from http://www.nisambe11.net/ekonomiz/2006q4/2006dec13p.4.htm

Ward, C. & French, N. (1997). The valuation of upwards-only rent reviews: an option pricing model. Journal of Property Valuation and Investment, 15(2), 171-182.