ESG as a Sustainability Approach in Corporate Real Estate Management

Main Article Content

Abstract

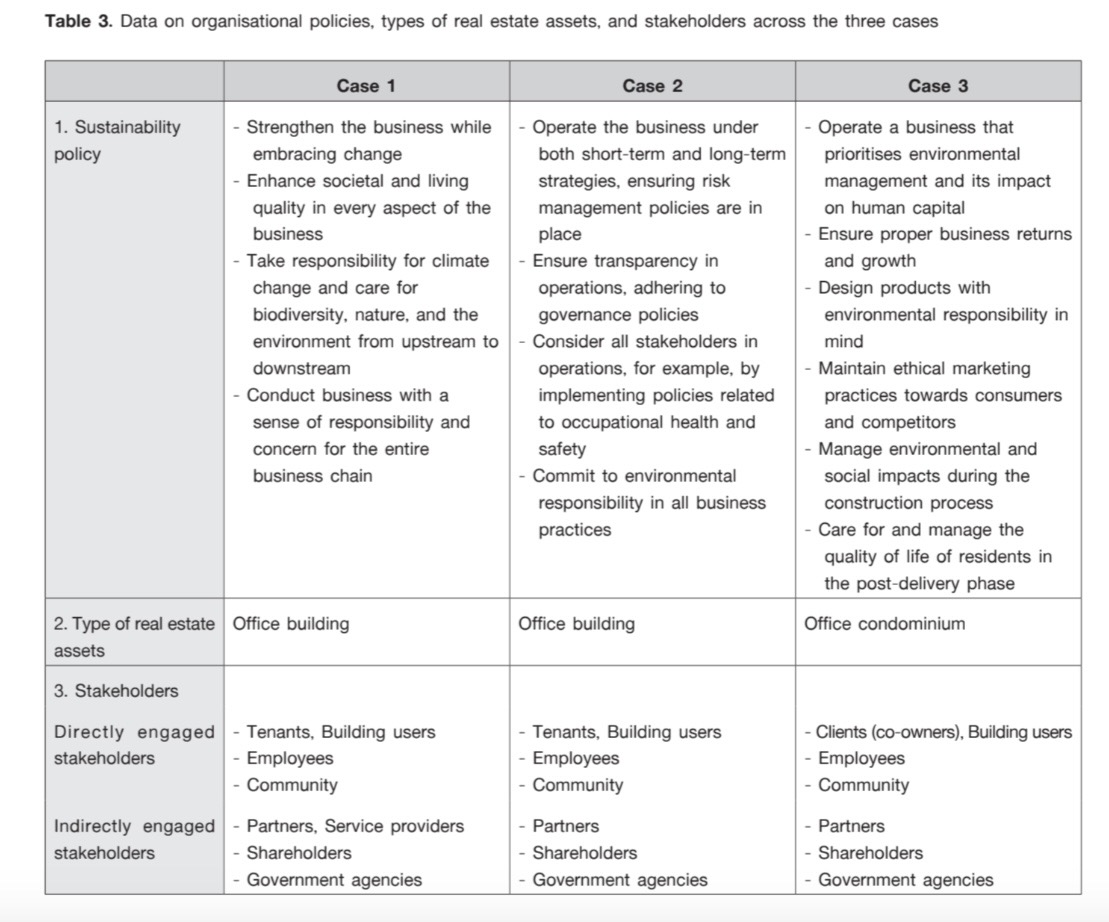

This study aims to examine the implementation of environmental, social, and governance (ESG) principles from a corporate real estate management (CREM) perspective and to propose guidelines for managing office buildings in alignment with ESG. A literature review identified sixteen aspects of CREM related to ESG principles and subsequently compared with findings from case studies. Three case studies from Bangkok, Thailand, were conducted to explore how these insights are applied in current practices. Criteria for case selection included office buildings in Bangkok owned by companies listed on the Stock Exchange of Thailand (SET) and recognised as Sustainable Stocks or Thailand Sustainability Investment (THSI) in 2021. Data were gathered through field studies, which involved surveying the physical environment of the organisation’s real estate assets, examining building operations, and assessing support services that promote the organisation’s sustainability objectives. Key stakeholder interviews were also conducted. The literature review suggests that while most CREM approaches related to ESG are applied in practice, the degree to which CREM aligns with ESG principles varies depending on organisational strategies, the type of real estate, and building conditions. The findings revealed that CREM practices, when classified under a specific aspect of ESG, also can be linked to other aspects. For example, waste management, classified under the environmental aspect, often involves in-office waste segregation, which requires employee involvement and is thus connected to the social aspect. This study introduces the integration of ESG principles with CREM, contributing insights and practical guidelines for implementation. By identifying connections between sustainability and real estate management, we present a framework for both academic research and practical application. Sixteen aspects linking CREM to ESG, identified in both theory and practice, have the potential to contribute to the added value of CREM initiatives.

Downloads

Article Details

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

All material is licensed under the terms of the Creative Commons Attribution 4.0 International (CC-BY-NC-ND 4.0) License, unless otherwise stated. As such, authors are free to share, copy, and redistribute the material in any medium or format. The authors must give appropriate credit, provide a link to the license, and indicate if changes were made. The authors may do so in any reasonable manner, but not in any way that suggests the licensor endorses you or your use. The authors may not use the material for commercial purposes. If the authors remix, transform, or build upon the material, they may not distribute the modified material, unless permission is obtained from JARS. Final, accepted versions of the paper may be posted on third party repositories, provided appropriate acknowledgement to the original source is clearly noted.

References

Akadiri, P.O., & Olomolaiye, P.O. (2012). Development of sustainable assessment criteria for building materials selection. Engineering, Construction and Architectural Management, 19(6), 666-687. https://doi.org/10.1108/09699981211277568

Ali, Z., McGreal, S., Adair, A., & Webb, J.R. (2008). Corporate real estate strategy: A conceptual overview. Journal of Real Estate Literature, 16(1), 3-22.

Aroonsrimorakot, S., & Phuynongpho, S. (2017). Factors affecting the water usage performance of standard application of green office in Thailand. Interdisciplinary Research Review, 12(2), 24–30. https://doi.org/10.14456/jtir.2017.10

Aroonsrimorakot, S., Laiphrakpam, M., Arunlertaree, C., & Korattana, C. (2019). Green office, its features and importance for sustainable environmental management: A comparative review in search for similarities and differences. Interdisciplinary Research Review, 14(5), 31-38.

Baykal Uluoz, E., & Inalhan, G. (2024). Shared workspace design: Elements of analysis for a healthy work experience. Journal of Corporate Real Estate, 26(2), 176-197. https://doi.org/10.1108/JCRE-04-2023-0013

Boge, K., Salaj, A., Bjørberg, S., & Larssen, A.K. (2018). Failing to plan – planning to fail: How early phase planning can improve buildings’ lifetime value creation. Facilities, 36(1/2), 49-75. https://doi.org/10.1108/F-03-2017-0039

Brown, R.K., Arnold, A.L., Rabianski, J.S., Lapides, P.D., Rondeau, E.P., & Rhodes, M.S. (1993). Managing corporate real estate. Wiley.

Colenberg, S., & Jylhä, T. (2022). Identifying interior design strategies for healthy workplaces – a literature review. Journal of Corporate Real Estate, 24(3), 173-189. https://doi.org/10.1108/JCRE-12-2020-0068

de Burgos Jiménez, J., & Céspedes Lorente, J.J. (2001). Environmental performance as an operations objective. International Journal of Operations & Production Management, 21(12), 1553-1572. https://doi.org/10.1108/01443570110410900

Denton, D.K. (1999). Employee involvement, pollution control and pieces to the puzzle. Environmental Management and Health, 10(2), 105-111. https://doi.org/10.1108/09566169910259769

Dorfleitner, G., Halbritter, G., & Nguyen, M. (2015). Measuring the level and risk of corporate responsibility–An empirical comparison of different ESG rating approaches. Journal of Asset Management, 16, 450–466.

Dresdow, G., & Tryce, R. (1988). Today’s corporate real estate demands better management. National Real Estate Investor, 30(10), 87-90.

Elsaid, S., & Aghezzaf, E.-H. (2015). A framework for sustainable waste management: Challenges and opportunities. Management Research Review, 38(10), 1086-1097. https://doi.org/10.1108/MRR-11-2014-0264

Friede, G., Busch, T., & Bassen, A. (2015). ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. Journal of Sustainable Finance & Investment, 5(4), 210-233. https://doi.org/10.1080/20430795.2015.1118917

Gharehbaghi, K., Georgy, M., Robson, K.M., Wilkinson, S., & Farnes, K. (2022). Versatility in sustainable building design (SBD) practices: An empirical study. International Journal of Building Pathology and Adaptation, 40(5), 728-752. https://doi.org/10.1108/IJBPA-10-2020-0092

Gibson, R., & Krueger, P. (2018). The sustainability footprint of institutional investors. Journal of Financial Economics, 129(3), 784-811. https://doi.org/10.1016/j.jfineco.2018.07.013

Goubran, S., Walker, T., Cucuzzella, C., & Schwartz, T. (2023). Green building standards and the United Nations’ Sustainable Development Goals. Journal of Environmental Management, 326 (Part A), 116552. https://doi.org/10.1016/j.jenvman.2022.116552

Huo, X., Yu, A.T.W., & Wu, Z. (2017). A comparative analysis of site planning and design among green building rating tools. Journal of Cleaner Production, 147, 352-359. https://doi.org/10.1016/j.jclepro.2017.01.099

Huo, X., Yu, A.T.W., & Wu, Z., (2018). An empirical study of the variables affecting site planning and design in green buildings. Journal of Cleaner Production, 175, 314-323. https://doi.org/10.1016/j.jclepro.2017.12.091

Inalhan, G. (2009). Attachments: The unrecognised link between employees and their workplace (in change management projects). Journal of Corporate Real Estate, 11(1), 17-37. https://doi.org/10.1108/14630010910940534

Jalil Omar, A., & Heywood, C. (2014). Defining a corporate real estate management’s (CREM) brand. Journal of Corporate Real Estate, 16(1), 60-76. https://doi.org/10.1108/JCRE-10-2013-0031

Jensen, P.A., & van der Voordt, T.J.M. (2020). Healthy workplaces: What we know and what else we need to know. Journal of Corporate Real Estate, 22(2), 95-112. https://doi.org/10.1108/JCRE-11-2018-0045

Joroff, M.L., Louargand, M., Lambert, S., & Becker, F. (1993). Strategic management of the fifth resource: Corporate real estate (Report of Phase One – Corporate Real Estate). The Industrial Development Research Council.

Kauko, T. (2019). Innovation in urban real estate: The role of sustainability. Property Management, 37(2), 197-214. https://doi.org/10.1108/PM-10-2017-0056

Kaur, T., & Solomon, P. (2023). The study of sustainability as a mediator of new approaches to work and workspace usage. Journal of Facilities Management, 21(1), 149-166. https://doi.org/10.1108/JFM-06-2021-0062

Knight Frank. (2020). Naifǣ rong læ phī phœ̄nsapēt prathēt Thai phœ̄i dai nā mi talāt phư̄nthī chao samnakngān nai Krung Thēp... lang kān rabāt khō̜ng wairat khō wit - sipkāo [Knight Frank and peoplespace Thailand reveals the dynamics of the office rental market in Bangkok after the COVID-19 pandemic]. Retrieved January 20, 2022, from https://thailandpropertynews.knightfrank.co.th/ไนท์แฟรงค์และพีเพิลสเป/

Krumm, P.J.M.M. (2001). History of real estate management from a corporate perspective. Facilities, 19 (7/8), 276-286.

Livingstone, N., & Ferm, J. (2017). Occupier responses to sustainable real estate: What’s next? Journal of Corporate Real Estate, 19(1), 5-16. https://doi.org/10.1108/JCRE-03-2016-0016

Manning, C., & Roulac, S.E. (2001). Lessons from the past and future directions for corporate real estate research. Journal of Real Estate Research, 22(1/2), 7-57.

Masalskyte, R., Andelin, M., Sarasoja, A.-L., & Ventovuori, T. (2014). Modelling sustainability maturity in corporate real estate management. Journal of Corporate Real Estate, 16(2), 126-139. https://doi.org/10.1108/JCRE-09-2013-0023

Meng, X. (2014). The role of facilities managers in sustainable practice in the UK and Ireland. Smart and Sustainable Built Environment, 3(1), 23-34. https://doi.org/10.1108/SASBE-03-2013-0012

Nielsen, S.B., Sarasoja, A.-L., & Galamba, K.R. (2016). Sustainability in facilities management: An overview of current research. Facilities, 34(9/10), 535-563. https://doi.org/10.1108/F-07-2014-0060

Nyoni, V., Piller, W.B., & Vigren, O. (2023). Sustainability action in the real estate sector — An organizational and institutional perspective. Cleaner Production Letters, 5, 100049. https://doi.org/10.1016/j.clpl.2023.100049

Omar Attallah, S., Senouci, A., Kandil, A., & Al-Derham, H. (2013). Utilization of life-cycle analysis to evaluate sustainability rating systems for construction projects with a case study on Qatar Sustainability Assessment

System (QSAS). Smart and Sustainable Built Environment, 2(3), 272-287. https://doi.org/10.1108/SASBE-03-2013-0017

Omer, M.A.B., & Noguchi, T. (2020). A conceptual framework for understanding the contribution of building materials in the achievement of Sustainable Development Goals (SDGs). Sustainable Cities and Society, 52(January), 101869. https://doi.org/10.1016/j.scs.2019.101869

Peukes, I.E., Francesco, P., & D’Amico, B. (2023). Life cycle assessment of 61 ducted gas heating upgrades in Australia. International Journal of Building Pathology and Adaptation, 41(1), 143-169. https://doi.org/10.1108/IJBPA-04-2021-0052

Richter, T.J., Soliva, E., Haase, M., & Wrase, I. (2022). Corporate real estate and green building: Prevalence, transparency and drivers. Journal of Corporate Real Estate, 24(4), 241-255. https://doi.org/10.1108/JCRE-05-2021-0016

Roulac, S.E. (1999). Real estate value chain connection: Tangible and transparent. Journal of Real Estate Research, 17(3), 387-404.

Sijakovic, M., & Peric, A. (2021). Sustainable architectural design: Towards climate change mitigation. Archnet-IJAR, 15(2), 385-400. https://doi.org/10.1108/ARCH-05-2020-0097

Sroufe, S. (2018). Design thinking – Life cycle assessment. Integrated Management (pp. 151-180). Emerald Publishing Limited. https://doi.org/10.1108/978-1-78714-561-020181010

St Lawrence, S. (2004). Review of the UK corporate real estate market with regard to availability of environmentally and socially responsible office buildings. Journal of Corporate Real Estate, 6(2), 149-161. https://doi.org/10.1108/14630010410812315

Surmann, M., Brunauer, W.A., & Bienert, S. (2016). The energy efficiency of corporate real estate assets: The role of energy management for corporate environmental performance. Journal of Corporate Real Estate,18(2), 68-101. https://doi.org/10.1108/JCRE-12-2015-0045

Taylor, M. (2005). Integrated building systems: Strengthening building security while decreasing operating costs. Journal of Facilities Management, 4(1), 63-71. https://doi.org/10.1108/14725960610644483

United Nations Environment Programme - Finance Initiative. (2019). Fiduciary duty in the 21st century. Retrieved January 15, 2022, from https://www.unepfi.org/publications/investmentpublications/fiduciary-duty-in-the-21st-century-final-report/

Ūsas, J., Balezentis, T., & Streimikiene, D. (2021). Development and integrated assessment of the circular economy in the European Union: The outranking approach. Journal of Enterprise Information Management, ahead-of-print. https://doi.org/10.1108/JEIM-11-2020-0440

Vieira de Castro, A., Ramírez Pacheco, G., & Neila González, F. J. (2020). Holistic approach to the sustainable commercial property business: Analysis of the main existing sustainability certifications. International Journal of Strategic Property Management, 24(4), 251-268. https://doi.org/10.3846/ijspm.2020.12174

Vigren, O., Kadefors, A., & Eriksson, K. (2022). Digitalization, innovation capabilities and absorptive capacity in the Swedish real estate ecosystem. Facilities, 40(15/16), 89-106. https://doi.org/10.1108/F-07-2020-0083

Walker, T., & Goubran, S. (2020). Sustainable real estate: Transitioning beyond cost savings. In D. M. Wasieleski & J. Weber (Eds.), Sustainability (Business and Society 360, Vol. 4, pp. 141-161). Emerald Publishing Limited. https://doi.org/10.1108/S2514-175920200000004008

Windapo, A.O., & Moghayedi, A. (2020). Adoption of smart technologies and circular economy performance of buildings. Built Environment Project and Asset Management, 10(4), 585-601. https://doi.org/10.1108/BEPAM-04-2019-0041

Zeckhauser, S., & Silverman, R. (1983). Rediscover your company’s real estate. Harvard Business Review, 61(1), 111-117.