A Cluster Analysis of Home Builders Based on Financial Resource Allocation

Main Article Content

Abstract

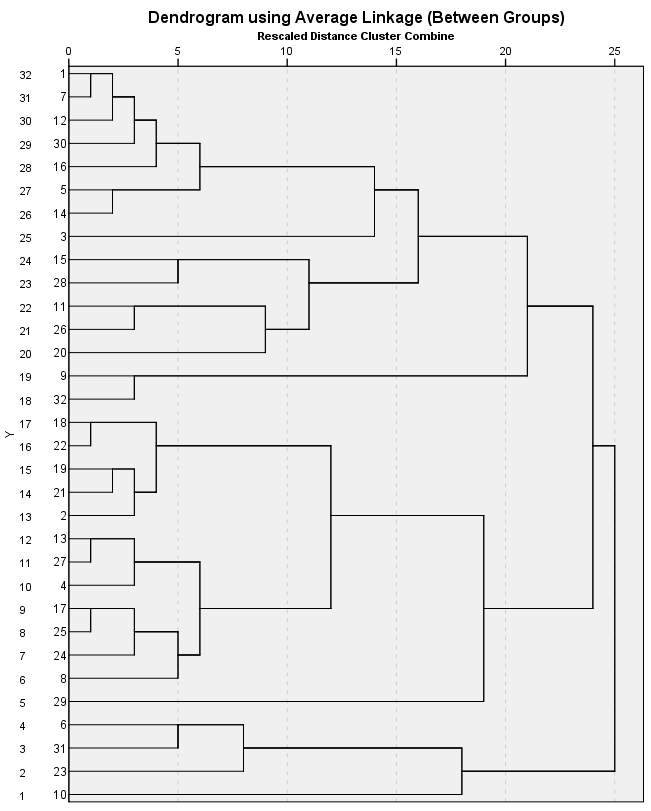

This research adopted a cluster analysis to cluster 23 home builders, based on proportion of financial resource allocation, into 3 groups. The results of the analysis of each group revealed that the home builder group 1 mainly focused on the competitive advantage from having high liquidity and investment in permanent assets in order to cut costs and enhance revenues. The home builder group 2 paid attention to other current assets such as construction equipment, in order to create the competitive advantage from having low construction costs. The home builder group 3 principally attempted to create the market from expanding debtor collection periods of accounts receivable, by mobilizing external financial sources to increase liquidity. The comparison of rate of return on equity among the three groups showed that the home builder group 2 possessed more potential to receive a little higher rate than that of the home builder group 1. Besides, the rate of return on equity of the home builder group 3 had high variation, compared to that of group 1 and 2.

Downloads

Article Details

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

All material is licensed under the terms of the Creative Commons Attribution 4.0 International (CC-BY-NC-ND 4.0) License, unless otherwise stated. As such, authors are free to share, copy, and redistribute the material in any medium or format. The authors must give appropriate credit, provide a link to the license, and indicate if changes were made. The authors may do so in any reasonable manner, but not in any way that suggests the licensor endorses you or your use. The authors may not use the material for commercial purposes. If the authors remix, transform, or build upon the material, they may not distribute the modified material, unless permission is obtained from JARS. Final, accepted versions of the paper may be posted on third party repositories, provided appropriate acknowledgement to the original source is clearly noted.

References

Alfan, E., & Zakaria, Z. (2013). Review of financial performance and distress: a case of Malaysian construction companies. British Journal of Arts and Social Sciences, 12(2), 147.

Guarav, D., & Abhay J. (2015). Evaluation of Indian Construction Companies using Financial Tool. IJSTE- International Journal of Science Technology & Engineering., 1(11), 210-216.

Halim, M. S. A., Jaafar, M., Osman, O., & Haniff, M.S. (2012). Financial Ratio Analysis: An Assessment ofMalaysian Contracting Firms. Journal of Construction in Developing Countries, Supp, 1, 71-78.

Ibn-H. N. T., & Tijai I. A., (2015). Financial analysis of a construction company in Saudi Arabia. International Journal of Construction Engineering and Management, 4(3), 80-86.

Nishane N. C., & Bhalerao N. V. (2017). Comparative financial Analysis of Construction companies in India. International Journal on Recent and Innovation Trends in Computing and Communication, 5(3), 368 – 371.

Pamulu, M. S., Kajewski, S. L., & Betts, M. (2007). Evaluating financial ratios in construction industry: a case study of Indonesian firms. 1st International Conference of European Asian Civil Engineering Forum (EACEF), 26 - 27 September 2007, Jakarta, Indonesia, E-158.

Phansri W., & Suriyanon N. (2019). Financial Ratios of Home Builder Industry. Engineering Journal of Siam University, 20(2), 1-16.

Rajasekhar, R. (2017). Financial Performance Evaluation of Construction Industries. International Journal of Scientific and Research Publications, 7(1), 157-175.

Syed M. A., Weihua M., Aarti P., & Juan, Z. (2005). Comparative Analysis Of Financial Statements of General Contractors. ASC Proceedings of the 41st Annual Conference, University of Cincinnati - Cincinnati, Ohio, April 6 – 9.

Sunanta, S. (2014). The comparison of financial ratios between companies listed on the Stock Exchange of Thailand and private company of the construction industry. Independent study Accounting commerce and Accountancy, Thammasat University.